Axis Bank Indian Oil Credit Card: Features, Benefits, Limit & More

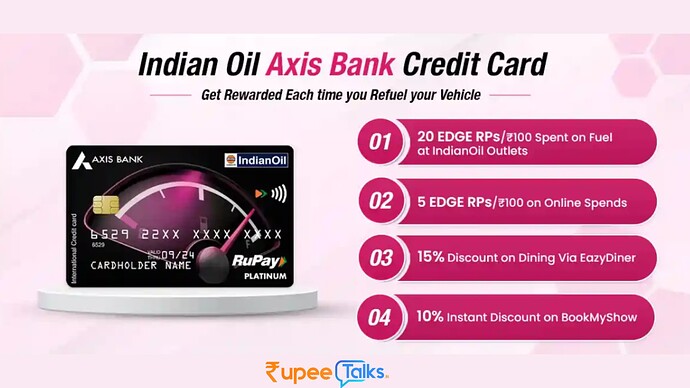

The Axis Bank Indian Oil Credit Card is a co-branded fuel credit card offered by Axis Bank and Indian Oil Corporation Limited (IOCL) which is designed for frequent fuel spenders. With a minimal joining fee of Rs.500, it offers a 5% reward rate on fuel spending at IOCL stations and 1% on online transactions.

Cardholders enjoy fuel surcharge waivers, movie ticket discounts, and exclusive dining offers under the Dining Delights Program. This card is ideal for entry-level users, this card combines affordability with savings, making it one of the best fuel credit card in India. Let’s dive deeper to know more about this card.

Key Highlights of Axis Bank Indian Oil Credit Card

| Best Suited for | Fuel |

|---|---|

| Joining Fee | Rs. 500 |

| Annual Fee | Rs. 500 (Waived off on spending Rs. 3.5 lakh in a year) |

| Welcome Benefits | EDGE reward points worth the 1st fuel transaction (max. 1,250 EDGE reward points worth Rs. 250), that is made within 30 days of card issuance |

| Best Feature | 4% value back on your fuel spends at IndianOil outlets |

Fees & Charges of Axis Bank Indian Oil Credit Card

| Type of Charge | Amount |

|---|---|

| Joining fee | Rs.500 |

| Annual fee | Rs.500 (waived if annual spends exceed Rs.50,000) |

| Finance Charge | 3.4% per month |

| Cash payment fee | Rs.100 |

| Outstation cheque fee | Waived |

| Cash withdrawal fee | 3.4% (Minimum of Rs.500) |

| Over-limit penalty | 3% of the over-limit amount subject to a minimum of Rs.500 |

| Late payment fee | Less than Rs.500: Nil, From Rs.501 to Rs.5,000: Rs.500, From Rs.5,001 to Rs.10,000: Rs.750, Greater than Rs.10,000: Rs.1,200 |

| Cheque return or dishonor fee | 2% of the payment amount subject to a minimum of Rs.450. |

| Foreign currency transaction fee | 3.5% of the transaction value |

Features & Benefits of Axis Bank Indian Oil Credit Card

Get Up to 4% Value Back

On fuel transactions made through accelerated reward points, cardholders can get up to 4% value back.

- Cardholders can earn up to 4% as a value back on fuel transactions.

- On every spend of Rs.100 at any IOCL station bank will provide 20 reward points. The offer is valid to fuel transactions ranging from Rs.100 to Rs.5,000 per month.

- On every Rs.100 spent on e-commerce shopping get 1% value back by receiving five reward points. The offer will only be applied to online transactions.

Welcome Benefit

- Enjoy a welcome benefit of 100% cashback of up to Rs.250 on all your fuel transactions within the card.

- The offer is applicable only if you made the transactions within 30 days of card issuance.

Fuel Benefits

- Accelerated reward points will be provided on all your fuel transactions made at IOCL stations across India.

- You can get 20 reward points on spending every Rs.100 for fuel

- To get accelerated reward points minimum purchase amount is Rs.100 and the maximum is Rs.5000.

- Cardholders get a 1% fuel surcharge waiver for all transactions made between Rs.200 to Rs.5000 per month.

Benefits on Sopping

- Get a 1% value back on all your shopping purchases made with this card as accelerated reward points.

- Cardholders receive five reward points for every Rs.100 spent.

- To be eligible for the accelerated reward points, the minimum purchase required amount is Rs.100 and the maximum is Rs.5000

Milestone Benefits

If you spend Rs.50,000 in a year, the annual fee is waived for the next year.

Benefits of Reward Points

- You will get 1 EDGE Reward Points on spending of every Rs.100 with this card.

- You can redeem these reward points to purchase a variety of products from Axis Bank’s reward catalog.

Dining Benefits

With the Dining Delights Program, you can get a 15% discount on all Axis Bank partner restaurants.

Entertainment Benefits

This card comes with exciting entertainment benefits which provide you an instant discount on movie tickets booked through BookMyShow.

To avail the discount, ensure you apply the offer from the offer section while doing the transaction.

IndianOil Axis Bank Credit Card Limit

The credit limit for the IndianOil Axis Bank Credit Card is determined solely at the bank’s discretion. Axis Banks consider several factors before proving the credit limit, which varies from person to person. These factors include the annual income of the primary applicant, credit report, credit score, and repayment history for past and current debts.

Eligibility Criteria

These eligibility criteria will be needed to get an Axis Bank IndianOil Credit Card:

Age Limit: Applicants age should be 18 to 70 years.

Individuals must be an Indian.

Occupation: Salaried or Self-Employed

Required Documents

- Address Proof: Ration Card, Voter ID, Passport, Aadhaar Card

- Identity Proof: PAN Card, Aadhaar, Passport

- Proof of Income: Salary Slip, IT Returns

Bottom Line

A great entry-level fuel card with 4% cashback on fuel and 1% on online spending, though offline rewards are low (0.20%). Competes closely with ICICI HPCL Super Saver and BPCL SBI cards, all with Rs.500 fee. While it’s a solid choice for frequent fuel users. Existing users, what’s been your experience with card? Share your thoughts.