Kotak 811 Super Savings Account Benefits, Fees & Charges or More

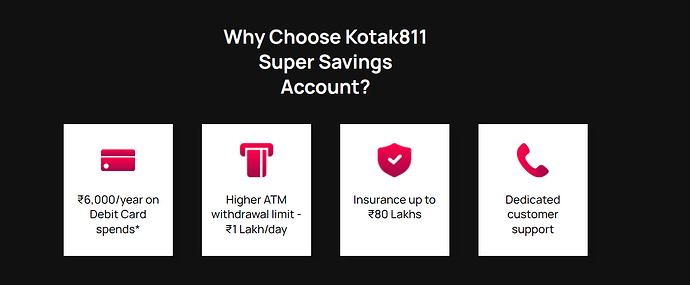

Kotak811 is bringing a premium digital banking experience to every Indian with its new Kotak811 Super Savings Account. With ₹6,000 cashback every year, a Platinum Debit Card, Dedicated Customer Care support and many more offerings, Kotak811 is set to redefine the savings account experience with its new 811 Super Savings Account.

NOTE: Enjoy FLAT 5% cashback up to Rs.6,000* per year (Rs.500 every month) on your Debit Card spends.

Kotak 811 Super Fees and Charges

| Particulars | 811 Super |

|---|---|

| Super Enrollment Fees | ₹300/yr |

| Average Monthly Balance (AMB) | 0 |

| Replacement of Lost Debit Card | ₹299 (Inclusive of all taxes) |

| Cheque Book | 25 Cheque leaves free/Yr. Thereafter ₹3/cheque leaf (Min 25 leaves in one chequebook) |

| Branch Transactions | 4 FREE (Up to ₹2 lakhs monthly) |

| Home Banking | Available @ ₹150/visit |

| ATM Withdrawals | 10 FREE Transactions (Kotak Bank ATM) 5 FREE monthly (Other Domestic ATMs*) |

How to apply for Kotak811 Super Savings Account?

Step 1: Fill in your details in the above form and complete the OTP authentication

Step 2: Make a deposit of ₹5,000 in your account. You can use this amount and enjoy 5% cashback*. An annual fee of ₹300 will be applicable.

Step 3: Once the deposit is successful, your 811 Super Account will be activated.

Steps To Convert 811 Savings Account to 811 Super Savings Account**

-

Check Account Type: Ensure you have an 811 Full KYC account.

-

Call Customer Service: Dial 1860 266 2666.

-

Speak to an Agent: After connecting, say, “I want to convert my account to an 811 Super Savings Account.”

-

Agent’s Explanation: The agent will provide details about the benefits of the Super Savings Account.

-

Account Balance Check:

- If you have 5,000 in your account, proceed.

- If not, the agent will instruct you to transfer 5,000 to your Kotak account.

-

Receive SMS: You will get a text message containing a specific and unique URL.

-

Click the URL: Open the URL from the SMS.

-

Accept Terms: Read and accept the terms and conditions.

-

Enter OTP: Input the OTP you receive.

-

Account Conversion: After entering the OTP, 300 rupees will be deducted, and your account will be successfully converted to an 811 Super Savings Account.

Why Choose Kotak 811 Super Saving Account?

- Higher withdrawal and spending limits

The 811 Super account comes with a platinum debit card that has a daily withdrawal limit of ₹1 lakh and a spending limit of ₹3 lakhs.

- Insurance coverage

The 811 Super account offers purchase protection of up to ₹1 lakh, air accident insurance of up to ₹50 lakhs, lost baggage insurance of up to ₹1 lakh, personal accidental death cover of up to ₹25 lakhs, and lost card liability of up to ₹3.5 lakhs.

811 Super - Terms & Conditions

811 Super eligibility:

- A minimum account balance of ₹5,000 is required to complete the FKYC/onboarding for the 811 Super program.

-

- On a monthly basis, the customer needs to do at least one customer-initiated credit transaction of a minimum ₹5,000 to get eligible for 811 Super cashback.

- The 811 Super program is available for one year from the date of subscription. After one year customer’s consent will be requested for program continuation.

- If the customer does not agree, the program will be discontinued, and the customer will be downgraded to a regular 811 zero-balance digital savings account.

- GSFC benefits of 811 Edge, as well as the promo code and classification code, will be revoked in case of discontinuation.

811 Super cashback:

- Eligible customers - Cashback to 811 super-eligible customers on Debit Card spends.

- Cashback construct - Flat 5% cashback to all 811 Super eligible customers on Debit Card spends through Kotak Debit card (E-com/ POS (Point of Sales) transactions) up to ₹500/month.

Rules:

- 811 Super-eligible customers should spend via Kotak Debit Card.

- To calculate the spend value only the following types of transactions are eligible:

- Virtual Debit Card

- Physical Debit Card transactions (E-com/POS)

Important Note:

- Inter or intra-bank funds will not be considered.

- ATM cash withdrawals will not be considered.

- Wallet-top-ups transfers from 811 Savings Account to any type of wallet) will not be considered.

- Any other type of transaction not mentioned above will not be included.

- Any type of UPI transactions will not be counted as spending.

Terms & Conditions for Cashback:

- Kotak Mahindra Bank has extended a cashback offer to 811 Super customers who meets the eligibility criterion to ₹5,000 in monthly credit.

- Customers will receive a flat 5% cashback on Debit Card spending.

- The maximum cashback a customer can earn is ₹500 per month.

- To qualify for the monthly cashback, eligible 811 Super customers must spend using their 811 Debit Cards.

- Fund transfers, ATM withdrawals, and wallet top-ups are not considered eligible spending.

- Cashback will be rounded down to the nearest whole number.

- A minimum spend of ₹20 is required to qualify for the cashback.

- Cashback will be credited within 30 days after the relevant month ends.

- The cashback is non-transferable.

- Participation in the cashback offer is voluntary.

- By participating, customers acknowledge that they have read, understood, and accepted these terms and conditions, along with the Bank’s general terms.

- Kotak Mahindra Bank reserves the right to modify, change or withdraw the cashback offer at any time without prior notice.

- The Bank may disqualify customers from the offer if fraudulent activities are detected.

- The ban’s decision regarding all matters related to the offer is final and binding.

- Any disputes related to this cashback offer will be subject to the exclusive jurisdiction of Mumbai courts.